Interesting Things to Know

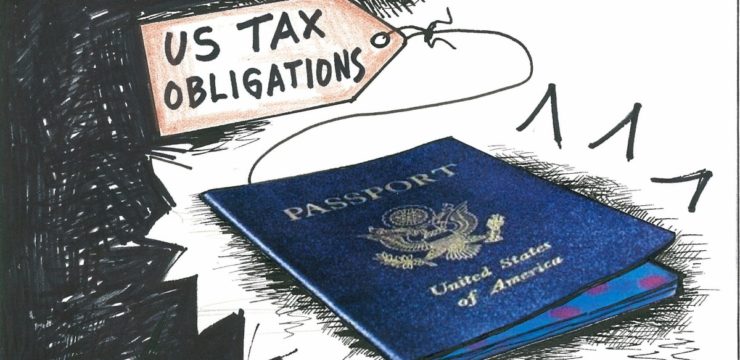

Americans renounce citizenship over taxes

There has been a noticeable increase in the number of U.S. citizens living abroad that choose to renounce their citizenship, and many have cited taxes as the primary cause, according to Forbes. Last year at least 5,133 citizens made the decision which followed an all-time high of 5,411 during the previous year. The numbers are likely much higher as these totals do not count anyone that didn’t file formal exit forms with the IRS. Currently, it costs $2,350 to formally relinquish an American passport.

The Foreign Account Tax Compliance Act of 2010 compels foreign countries to provide information to the U.S. government regarding the finances of expatriates. Because Americans must often pay taxes to the state in which they are living, as well as to the U.S., it can be impossible to avoid becoming double-taxed on the same income despite receiving a foreign tax credit. Penalties for noncompliance can include fines and criminal charges.