The House was back in session last week, with an extra day of session on Saturday to finish out the week. House Republicans brought forward various...

Last week, the House continued to struggle with the question of how to address our ballooning deficits while funding the core functions of the Federal government....

As the 118th Congress convenes Washington for the second year of the session, House Republicans are determined to pursue a responsible spending deal that cuts wasteful...

The Christmas season is a special time for many folks across the Sixth District and throughout the Nation, and it serves as an important reminder of...

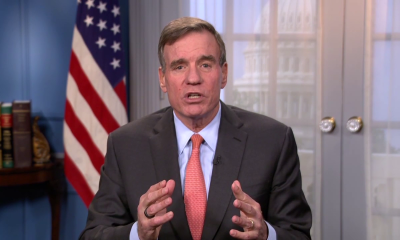

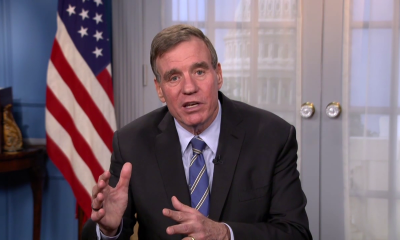

Happy Holidays from the Warner press office. In a year of pure chaos and disorder in the House of Representatives, Sen. Warner soldiered on and found creative...

Congressional Letter Demands Rollback of Rule Extending Use of ARP Funds. WASHINGTON, D.C. – In a bold move, Congressman Ben Cline (R-VA), Chairman of the Republican...

New Bill Seeks to Curtail Funding of DEI Programs with Taxpayer Money. WASHINGTON, D.C. – Congressman Ben Cline (R-VA) has introduced a significant piece of legislation,...

Legislation Aims to Ensure Federal Regulations are Issued by Senate-Confirmed Officials. In a significant legislative move, the U.S. House of Representatives has passed Congressman Ben Cline’s...

The Protecting America from Spies Act Seeks to Fortify U.S. Borders Against Foreign Espionage. In a bold move to safeguard national security, Congressman Ben Cline introduced...

Address Your Concerns with Federal Agencies on November 14th. Congressional representation goes beyond casting votes and debating policies; it’s about genuinely understanding the challenges and aspirations...

WASHINGTON – Today (Oct. 19), U.S. Sens. Mark R. Warner and Tim Kaine (both D-VA) announced $71,816,110 in federal funding to reduce power outages, enable more...

Senators Warner & Kaine Sound the Alarm on Funding Delays and Business Impact. As the clock ticks down with only a day left to the government...

Investments Aim to Bolster Safety, Infrastructure, and Economic Potential. Virginia’s skies are about to become safer and more efficient. Today, U.S. Senators Mark R. Warner and...

House Republicans have hit the ground running during the District Work Period, highlighting how the new House Republican Majority continues to deliver on our Commitment to...

A Direct Link Between Constituents and their Representative. In a bid to foster open communication and transparency, Congressman Ben Cline has announced the next Mobile Office...

Letters raise the urgent need for companies to expand and deepen their commitments to safeguard against misuse. WASHINGTON – U.S. Sen. Mark R. Warner (D-VA), Chairman of the Senate...

It was great to be back home in the Sixth District and hear directly from folks up and down the Valley about the issues most...

Warner and Colleagues Rally Behind Stronger Measures Against Spam Calls In a unanimous bid against the widespread menace of robocalls, U.S. Senator Mark Warner, backed by...

Concerns Rise Over Potential Inaccuracies in Google’s Med-PaLM 2 Medical Chatbot The rapidly evolving realm of AI in healthcare has witnessed increased scrutiny, as U.S. Sen....

A New Frontier in Medical Accessibility and Substance Control Discussed by U.S. Senator Mark R. Warner U.S. Sen. Mark R. Warner (D-VA) has voiced his approval...

Sen. Warner takes charge with a suite of comprehensive bills and initiatives. From the bustling chambers of the Senate to the local racetracks of Virginia, Senator...

U.S. Sen. Mark R. Warner, Chairman of the Senate Select Committee on Intelligence and a staunch advocate for technology responsibility has firmly pressed the Biden administration...

Chesapeake Bay SEEE Act Seeks to Enhance Bay Watershed Health and Ecosystem Management The illustrious Chesapeake Bay, the largest estuary in the U.S, has garnered the...

Secures Important Wins Amidst Challenging Times in Washington It has been an intense week on Capitol Hill as Congressman Ben Cline and House Republicans rally together...

From health care to air travel, Warner champions causes close to the Commonwealth’s heart. It’s been a whirlwind of a week for Senator Warner as he...

Cline stands up for military, taxpayers, and free speech while critiquing Biden Administration’s foreign policy Congressman Ben Cline (R-VA) has been busy recently, taking strides in...

Assisting Virginians Through Passport Delays and Advocating for Improved Living Conditions Sen. Warner of Virginia has had a busy week engaging with different communities and pushing...

In a recent move to better support military families, U.S. Senators Mark R. Warner and Tim Kaine have expressed concerns over the inconsistent implementation of housing...

In an announcement on June 26, 2023, U.S. Sen. Mark R. Warner (D-VA) heralded a colossal federal funding allocation of nearly $1.5 billion for the deployment...

Senator Mark R. Warner has been exceptionally busy this week, tackling various critical issues both at home and abroad. From strengthening the U.S.-India relationship to advocating...