Many people slow down after retirement. Lillian Sloan did the opposite. Now nearly 100 years old, Sloan still volunteers at...

The Town Council’s work session of March 2 began with the appointment of Hillary Wilfong to the position of Temporary...

Front Royal’s tourism office is inviting local businesses and community partners to take part in a Tourism Summit aimed at...

The Warren County Sheriff’s Office has a new captain — and a full calendar of community events. Captain Chris Powell,...

Following a motions hearing on Friday, February 27, the Virginia Beer Museum and Town of Front Royal are headed to...

Spring is beginning to show itself across Front Royal. The days are longer. Green shoots are pushing through the soil....

With the 2026 Virginia General Assembly session entering its final days, lawmakers in Richmond are wrapping up months of debate...

A follow-up hearing date of April 20th has been set to review the findings of independent psychological evaluations ordered by...

The following is a list of highway work that may affect traffic in Warren County in the coming weeks. Scheduled...

Small businesses interested in working with the Commonwealth of Virginia will soon have a chance to learn how to navigate...

Notice is hereby given that I, Irvin Coates, will not be responsible for any past, present, or future debts incurred...

Warning: This story describes inappropriate and illegal care provided by a well-intentioned finder and may be disturbing to some readers....

Front Royal Police Department’s arrest report for the past 7 days:

Virginia State Police say they are still actively investigating the abduction and homicide of Alicia Showalter Reynolds, 30 years after...

In a recent interview at the Royal Examiner studio, author Will Hackman did not ease into his message. “I’m a...

Coldest Night of the Year (CNOY) is a concept that was launched in Canada and has since spread across the...

An unassuming building adjacent to Skyline Middle School off Luray Avenue, the Blue Ridge Technical Center is a thriving hub...

Residents of the South River District will have an opportunity to speak directly with local leaders during an upcoming informal...

The Warren Heritage Society will welcome guests for a spring-themed afternoon tea on March 17 from 2 to 4 p.m....

Laurel Ridge Community College will celebrate the humanities with a week of discussions, art, film, and student creativity during Humanities...

As communities across the nation prepare to mark America’s 250th anniversary, Middletown will host a traveling exhibit that brings the...

You can find and register for all library events on our website, www.samuelslibrary.net. One-Time Events: Community Resource Fair Wednesday, March...

Malcolm Barr Sr., who turns 93 on Tuesday, March 10 — born 1933 — will celebrate his birthday at the...

The Commonwealth of Virginia will celebrate the service and sacrifice of women in uniform during Virginia Women Veterans Week, set...

These are the events being presented by the Youth Services Department at Samuels Public Library during the month of March...

March is shaping up to be a busy month at Raymond R. “Andy” Guest Jr. Shenandoah River State Park, with...

The Salvation Army of Front Royal is inviting the community to gather for its Annual Dinner on Friday, April 24,...

Join us Tuesday, February 17, as the Warren County High School boys basketball team takes on Brentsville High School. The...

Warren County High School is gearing up for a high-energy basketball game as the Lady Wildcats host the James Wood...

Warren County High School boys basketball fans can mark their calendars for an exciting Friday night matchup as the Wildcats...

I realized something recently—I haven’t spoken to many people face-to-face in quite a while. Most days I’m walking through the...

Supervisor Richard Jamieson is correct that Virginia’s current congressional map scores well on certain proportionality measures, but proportionality alone is...

Key Takeaways Virginia’s current congressional map is the most proportionally accurate in the nation — a gap of just 0.6...

The Front Royal Planning Commission recommended approval of an ordinance to allow a second house, aka accessory dwelling unit (ADU),...

As someone whose Quaker roots run many centuries deep in this part of Virginia, I have long been mindful of...

Democracies don’t usually collapse in a single dramatic moment. They erode when powerful people normalize the idea that elections are...

Helen Przepiorka Stuart, daughter of the late Jacob & Margaret Przepiorka, died at Lynn Care Center in Front Royal, VA,...

Donald Wayne Powell, 84, of Winchester, Virginia, passed away on March 6, 2026, in the comfort of his home. A...

William Gladwell Mason “Bill” Wilson, 89, passed away peacefully on March 2, 2026. Mr. Wilson was born on September 7,...

Thomas Ray “Tom” Lomax, 72, of Linden, Virginia, passed away on Saturday, February 28, 2026, at Warren Memorial Hospital. A...

Barry Richard Hadley, 69, of Strasburg, took that country road home on February 23, 2026. Barry was born on January...

French Earl Tolliver Jr., age 65, formerly of Front Royal, passed away peacefully on February 28, 2026. There will be...

Richard “Eddie” Edward Henderson, 60, of Front Royal, Virginia, passed away on Friday, February 27, 2026, at UVA Medical Center....

Elizabeth Anne “Libby” Fox, 78, of Front Royal, Virginia, went home to be with her Lord and Savior on Friday,...

David Lee Corbin, 56, of Winchester, Virginia, passed away suddenly on Wednesday, February 25, 2026, at Winchester Medical Center. A...

While former Democratic congressman Tom Periello’s 2010 vote in favor of establishing the Affordable Care Act contributed to him being...

Virginians can once again fish and swim in portions of the Potomac River that were affected when a sewage pipe...

Kenneth Canty, a Georgia infrastructure company owner, hopes to help restore the Francis Scott Key Bridge by repurposing the large...

At the core of a new Bedford County-based lawsuit challenging Virginia’s pending reproductive rights amendment is an allegation that House...

As early voting began Friday for Virginia’s closely watched redistricting referendum, Democratic leaders pushed back against claims that the proposal...

Gov. Abigail Spanberger said Virginia will continue focusing on job creation and economic growth after new federal data showed the...

RICHMOND, Va. — Bills to foster maternal health care resources for pregnant and postpartum incarcerated women have recently passed the...

RICHMOND, Va. – Lawmakers debated whether to expand career readiness to high school students in Virginia, but ultimately, the concerns...

RICHMOND, Va. — Over a dozen climate organizations and hundreds of advocates attended Virginia Climate Lobby Day at the State...

(WASHINGTON) – Republican and Democratic lawmakers are voicing frustration with the Pentagon’s lack of communication with Congress about the escalating...

(WASHINGTON) – As power costs surge across Maryland, the state’s congressional delegation is taking a bipartisan stance in support of...

WASHINGTON — President Donald Trump said Thursday that Homeland Security Secretary Kristi Noem will be leaving the post for a...

The national average price of a gallon of regular gasoline topped $3 Tuesday for the first time this year, and...

With solemn ceremony, three American soldiers — one living and two honored posthumously — were awarded the Medal of Honor,...

WASHINGTON — President Donald Trump said Monday he expects war with Iran will continue, however long it takes to achieve...

Finding someone you trust to care for your children can feel like a big task. Whether you need a babysitter...

More than a decade ago, Amazon founder Jeff Bezos said the online retail giant would open brick-and-mortar stores — but...

In difficult times, it can feel as though anger, grief, and uncertainty are everywhere. News headlines, personal struggles, and daily...

Every day, thousands of Americans suffer eye injuries on the job. The good news? Experts say up to 90 percent...

Flooding has become a growing concern for many homeowners as weather patterns grow more extreme and unpredictable. Heavy rainfall, overflowing...

When our Founders drafted the Constitution, they envisioned three branches of government with equal strength, balanced by a system of...

Few dishes have traveled the globe quite like the meatball. For centuries, cooks searching for a hearty, simple dinner have...

For many households, spring cleaning is a yearly tradition that signals a fresh start for the season ahead. While the...

A new federal tax deduction may help ease the cost of buying a new vehicle — but experts say it...

March marks National Nutrition Month®, a time dedicated to helping people make healthier food choices and build better eating habits....

It’s been right in front of you your entire life. Your nose sits between your eyes, in the middle of...

As International Women’s Day approaches on March 8, it is fitting to remember one of America’s most groundbreaking leaders —...

Delegate Delores Oates (R–31st District) provided constituents with a Week 7 update from the Virginia General Assembly, focusing on budget...

The Warren Heritage Society will reopen to visitors on March 4, welcoming the community back with expanded access to its...

The following is a list of highway work that may affect traffic in Warren County in the coming weeks. Scheduled...

Virginia State Police (VSP), working alongside federal and local law enforcement partners, reported significant criminal interdictions across the Commonwealth between...

March is shaping up to be one of the busiest months of the year at Samuels Public Library, with programs...

The North Warren Volunteer Fire Department is bringing back a longtime community tradition, and this time, it’s helping fund a...

Front Royal’s history may be well known, but local author Samantha Warren is giving it a supernatural twist. Warren, a...

Samuels Library was the last of 12 outside agencies on the Warren County Board of Supervisors Work Session agenda of...

Inside the Student Union, the atmosphere felt less like a formal luncheon and more like a family gathering — educators,...

Uplifting at its beginning and standing in solidarity at its end, the February 23 meeting of the Town Council covered...

Front Royal Police Department’s arrest report for the past 7 days:

This adult Bald Eagle was brought to the Center after being found unable to fly and breathing heavily. Thanks to...

A 33-year-old man is being held without bond following a domestic assault that escalated into a barricade situation and fire...

The nation’s drug landscape continues to evolve, and law enforcement agencies are warning about a dangerous new trend known as...

In a time when many communities are seeking solutions close to home, the Hike Kidz Foundation is firmly planting its...

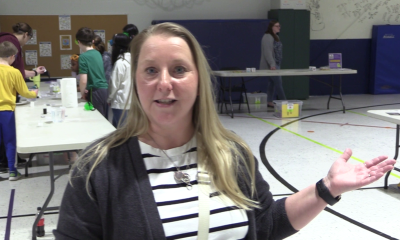

Rockets blasted off, robots zipped across the floor, and young engineers designed everything from moon bases to model satellites as...

The Lord Fairfax Health District (LFHD) is expanding its Women, Infants, and Children (WIC) program services by updating its clinic...

Supporters of the Shenandoah Rail Trail are applauding a decision by the Commonwealth Transportation Board (CTB) to move forward with...

Employee Appreciation Day falls on Friday, March 6, 2026 — a simple but meaningful reminder to recognize the people who...

With an estimated 68 million pet dogs across the United States, it’s no surprise that certain names keep popping up...

When the first Olympic Games were held in 776 B.C. in Olympia, Greece, the program was simple. There was only...

Do you share a birthday with a celebrity? 1 – Catherine Bach, 72, actress (Dukes of Hazzard), Warren, OH, 1954...

For generations, Saks Fifth Avenue stood as a symbol of luxury. Shoppers traveled to its flagship store in New York...

Supermassive black holes are usually found at the centers of large galaxies, acting as cosmic anchors. But astronomers have now...

If you experience uncomfortable physical or emotional symptoms in the days leading up to your period, you may be dealing...

During our recent political difficulties, it has become increasingly hard to keep up with the lingo—especially the labels. For example,...

So your knees ache on the stairs, the kids’ old bedrooms sit unused, and the yardwork is starting to feel...

Sports offer tremendous physical and mental health benefits—but not every child thrives in a team setting. If your child isn’t...

It’s no secret that phones are addictive. Between endless notifications, social media scrolling, and quick glances that turn into hours,...

Chai tea lovers, meet your new favorite cozy beverage. This maple-kissed spice blend delivers the warming flavors of classic chai...

One of the most interesting perspectives when traveling in Europe is the sense of time. Many cities are divided between...

For many college freshmen, moving out of their childhood home means moving in with a roommate—often someone they’ve never met....

Want to make your coffee table look like it’s straight out of a designer photoshoot? Whether your table is wood,...

Scientific breakthroughs are often portrayed as the result of careful planning and brilliant insight. But history shows that chance, mistakes,...

Funeral prearrangements allow you to make important decisions about your end-of-life arrangements in advance. These plans can include everything from...

Virginia’s housing market opened 2026 with renewed momentum, as pending sales posted a significant increase in January amid stabilizing mortgage...