Local Government

Supervisors Review Departmental Budgets and Revenue Streams as Fiscal Year-2026 approaches

Prior to the Homesteaders Working Group presentation, as the final month of Fiscal Year-2025 approached with the pending arrival of June, a dizzying graphics presentation of projected County revenues and departmental budget expenditure requests was run through with Finance Director Alisa Scott available, with department heads, to respond to potential questions. It was Finance Director Scott covering much of the board questions on just what those numbers indicated.

Grab your departmental purse strings and don’t let go till this analysis is done, and maybe not even then, you’ve got 4-1/2 weeks left till FY-26. Royal Examiner Photos Roger Bianchini, other than agenda packet graphics

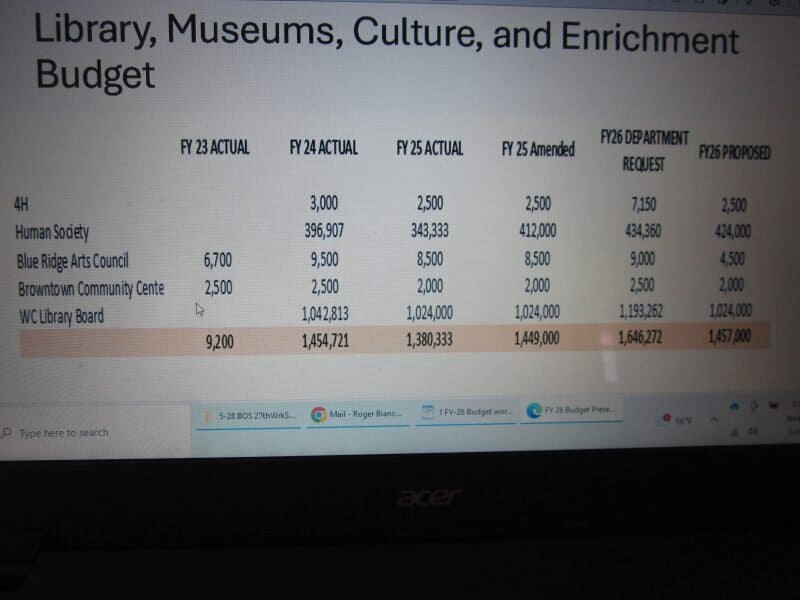

While the presentation was fairly straightforward, with a series of assisted summaries of the various budget, revenue, and projected expenditure categories, one thing caught our attention. That was when the “Library, Museums, Culture, and Enrichment Budget” category was pulled up. There was a long silence before the graphic category was moved past without a word being uttered.

A look at the agenda packet graphic for “Library, Museums, Culture, and Enrichment” showed five involved entities: the 4-H Center, the Blue Ridge Arts Council, the Browntown Community Center, and the newly created WC Library Board. The annual budgets dated back to FY-23 through the approaching FY-26, that latter year’s proposed budget showing both the departmental request and the apparent staff and/or supervisors “Proposed” amount, all less than requested.

We focused on the bottom row “WC Library Board” budget. As indicated in the graphic below, it showed no budget for FY-23, the year prior to its creation by the supervisors’ majority, then successive annual “Actual” budgets of $1,042,813 in FY-24, $1,024,000 in FY-25, and $1,193,262 requested and $1,024,000 “Proposed” for FY-26.

The “Library, Museums, Culture, and Enrichment” budgeting summary, while of some public interest, did not draw public comment from the supervisors.

We could only guess whether those final two numbers reflected budget projections for a new proposed Public/Private Partnership public library entity, Library Systems & Services (LS&S) funding. For it is LS&S that the 4-person supervisor majority and its appointed WC Library Board have focused on replacing Samuels Public Library with. That focus appeared to blossom in the wake of an initial written proposal from LS&S indicating its willingness to allow the supervisors and its hand-picked County Library Board negotiating body to dictate public library operational and content parameters moving forward.

That decision has come despite what appears to be a distinct countywide majority citizen support of the award-winning Samuels Public Library. Those awards and recognitions include Virginia’s current “Library of the Year 2024, with its history of a wide variety of useful programs for both adult and youth citizens of this community, in addition to its extensive selection of library books. It is a selection the Samuels Board of Trustees asserts belongs to the Samuels non-profit entity, along with other interior items, as they were said to be paid for with citizen donation or endowment funds rather than County tax revenue.

Library supporters believe the library hierarchy’s refusal to bow to the 2023-24 “Clean Up Samuels” led effort to have all LGBTQ material removed from the library has led to the supervisor majority’s effort to end a Public/Private Partnership dating indirectly to 1799. That is the year when the applying private entity that evolved into Samuels was State-approved as the second certified public library in Virginia.

See Royal Examiner’s synopsis of the FY-26 budgetary presentations below.

BOS Budget Work session

The work session meeting opened at 5:02 p.m., with a quorum of the Board of Supervisors present. “We’ve got a working group and we’re still waiting for two of the Board of Supervisors to arrive. But since we do have three board of supervisors here, which constitutes a quorum, we’re going ahead and get started,” Chairman “Jay” Butler announced.

Budget Overview and Revenue Notes

The first topic was a line-by-line overview of the proposed FY-2026 budget. Budget staff reminded the board that the county was working within tight fiscal constraints. “This is all the money there is,” staff explained. “So you can reduce, or you can move, not necessarily increase.”

A county board majority has made it clear it does not see raising taxes to produce additional revenue, even to maintain publicly supported services like law enforcement, Fire & Rescue, or County Public Schools, as a viable option in a tight economic environment for its citizens.

A few key themes emerged during the discussion:

Sales tax revenue was flagged as uncertain, with staff warning, “Sales tax do concern us. We will be watching them during the year.”

The use of money from investments could go up, but as one administrator said, “If the money is all invested at the state level … you can take your total and just multiply it times 4.5%. If it’s in various and sundry other places … we can only wing it.”

Shifts in federal COVID relief funding were also discussed, with a clear drop-off after ARPA funds dried up. “You paid the last of your ARPA money out the first half of 2025,” one staffer noted.

Department Budgets in Focus

A number of departmental changes were discussed, including:

Commissioner of the Revenue: A planned software purchase was moved to the FY-27 budget. Supplies dropped from $68K to $21.9K. “She thought that was paid … and that it would then drop,” said staff. Some of the costs were also moved to the reassessment budget.

Commonwealth’s Attorney: Three new positions were added with full state funding. “They added three new positions … the state took on the funding that was previously county funded.”

Fire and Rescue: There was a detailed discussion on overtime pay structures. “So our overtime does not kick in until you achieve that 50-hour marker, not 40 hours,” explained a department representative.

Assistant Fire & Rescue Chief Gerry Maiatico addresses departmental budgetary questions as others wait their turn.

Sheriff’s Office and Public Works: Clarifications were made on how holiday and regular overtime are calculated and reimbursed.

Sanitary Districts and Public Works: The board sought clarification on how general fund money supports labor and overhead not directly paid by the districts themselves. “Any work that’s done… is coming out of that pot of money that we as the Board of Supervisors approve during the tax,” one member noted.

Parks and Recreation Questions

Supervisor concerns were raised about the Parks and Recreation department recovering just 30% of its costs through user fees. “That’s 673K that’s coming out of the general fund … I just wanted to bring that to everyone’s attention,” said one supervisor.

Staff explained that revenues collected by Parks and Rec, such as registration fees, go into the general fund and are not directly returned to the department. “What you’re providing a service for, we’re not getting that money back for that service,” said a staffer from the department. “We couldn’t offer any bus trips this year.”

Pickleball was used as an example: “It’s $3 a drop-in. I think we made $170 last season and the pickleball net is like $40 on Amazon … They asked, ‘Where’s the money we paid you?’”

School Debt and County Contributions

The school division’s debt and contributions were also discussed, particularly a $450,000 payment that was previously handled by the school budget but was now being picked up by the County.

“They just forgot to tell you about it,” one official said bluntly. The debt is tied to energy bonds, for which the schools receive a 30% rebate. “So when they tell you you’re only giving them a 2.5% increase, you’re actually giving them five,” the chair noted.

A supervisor added, “That reminds me of when my son comes to me and says, ‘Hey Dad, can I borrow 20 bucks?’… Then later says he has $40. I go, ‘How about that change?’ and he goes, ‘Oh, I forgot that.’”

Airport and Enterprise Fund Discussion

Supervisors examined the county’s financial relationship with the local airport. One member questioned the fairness of continuing to allocate $23,000 in personal property tax revenue to the airport enterprise fund when it now generates fuel sales revenue.

“That 23K … could help pay for a teacher’s assistant,” a supervisor noted. Others confirmed the airport fuel profit is modest — around $35,000 per year. “We were running about $3.75 per gallon cost and selling for about $4.85,” said one staffer.

So, the FY-26 budget ball rolls into the final month of FY-25, with many variables and some unanswered questions still involved.