Real Estate

State of the Market: 2023 Forecasts higher prices, steady sales in Northern Shenandoah Valley

There is a lot of speculation around the real estate market in today’s society. Everyone with access to television or an internet connection is exposed to some kind of information about real estate. It’s all different, some good and some bad, but there is one common theme: regardless of the source or quality of the information, it all gets treated like gospel. Opinions aside, the simplest (and most reliable) way to settle the debate is to look at the numbers.

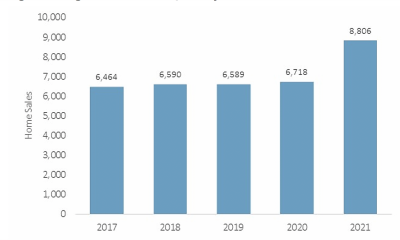

The Northern Shenandoah Valley comprises five counties and one city: Clarke, Frederick, Page, Shenandoah, Warren, and Winchester. All the data in this article is from public records from the Multiple Listing Service (MLS). The MLS is a database that real estate brokerages use to “host” their listings so that everyone can view them from one centralized location. When you look at real estate listings online, for example, you’re most likely viewing data that has been uploaded to the MLS. In order to understand what the future holds, it’s important to look at what’s already happened in the past. For that reason, I went back and looked at all the numbers from our region since 2019. There has undeniably been a rise and fall of total home sales in that time:

| Number of Sales | 2019 | 2020 | 2021 | 2022 |

| Clarke | 207 | 269 | 283 | 205 |

| Frederick | 1698 | 1922 | 1888 | 1450 |

| Page | 195 | 236 | 271 | 262 |

| Shenandoah | 716 | 845 | 801 | 750 |

| Warren | 764 | 890 | 919 | 688 |

| Winchester | 332 | 400 | 403 | 299 |

This can be attributed to a number of factors, including the push for homeownership in the “stay at home” phase of the COVID-19 pandemic and the slowdown from the recent increase in mortgage rates. Throughout this time, however, there has been another constant. Average prices have gone up – year over year – in every locality:

| Avg. Sale Price | 2019 | 2020 | 2021 | 2022 |

| Clarke | $391,000 | $454,000 | $494,000 | $629,000 |

| Frederick | $291,000 | $318,000 | $370,000 | $416,000 |

| Page | $203,000 | $236,000 | $268,000 | $295,000 |

| Shenandoah | $215,000 | $235,000 | $278,000 | $299,000 |

| Warren | $253,000 | $294,000 | $352,000 | $368,000 |

| Winchester | $252,000 | $300,000 | $324,000 | $364,000 |

It’s important to remember that another factor that could explain the lower number of total sales is less inventory on the market. Basically, the demand for housing is eating through all the houses available for sale. Increasing prices have clearly not scared buyers away, as the average Days on the Market has reduced drastically over the last four years:

| Days on Market | 2019 | 2020 | 2021 | 2022 |

| Clarke | 51 | 54 | 25 | 22 |

| Frederick | 46 | 39 | 16 | 23 |

| Page | 99 | 79 | 34 | 30 |

| Shenandoah | 78 | 54 | 25 | 23 |

| Warren | 56 | 39 | 24 | 27 |

| Winchester | 49 | 41 | 18 | 20 |

Simply put, while there may be fewer transactions taking place right now, they’re happening for more money in less time. So, what’s the cause of this stability in our real estate market? The answer is complex as there are several factors at play. The most significant factor is the continued growth of Washington, D.C., and Northern Virginia pushing out to the west. Along with that growth comes an increase in many different industries, with government; technology; manufacturing; and logistics being key contributors. As we continue to see the development of industries throughout the region, along with that will come more population growth and, inevitably, more activity in the housing market. According to Old Dominion University’s State of the Commonwealth Report for 2021, the Winchester region was the fastest-growing region in all of Virginia. In 2022, the Winchester region remained insulated from much of the economic woes experienced in other parts of the Commonwealth.

Some financial experts expect mortgage interest rates could continue to drop from the rate hikes we saw in the Fall of 2022. When rates drop, historically speaking, housing prices continue to rise. Spring Market (often the busiest time of year in real estate) is just around the corner, which means buyers will be positioned in the perfect place to achieve their goals in the real estate market – whether that might be to buy their first home, sell their current home to upgrade or downsize, or even take a chance on an investment property. No matter the desired outcome, the time to start preparing to buy is now, because the stars are aligned for another steady year in the real estate market for the Northern Shenandoah Valley.

Paul Bernd is a local REALTOR® from ERA Valley Realty in Woodstock, Virginia. If you have any questions about the real estate market, you can find him on social media @paulberndrealtor, call him at (540) 481-4825, or visit his website at www.PaulBernd.com.

Real Estate

Retirees Flock to Southern Appalachia, Sparking Real Estate Boom and Challenges

The allure of the southern Appalachian Mountains has become irresistible for many retirees, leading to a real estate boom and significant changes in the region. For decades, retirees from the northern United States have flocked to Florida. Still, many are opting to settle halfway down in the picturesque landscapes of North Georgia, Virginia, North Carolina, and other nearby states. These retirees, nicknamed “half-backs,” are reshaping Southern Appalachia’s demographics and real estate market.

Historically, the Appalachian region has been one of the least developed in the United States. However, this is rapidly changing with an influx of retirees, including those moving back north from Florida. Between April 2020 and July 2022, the population in southern Appalachian counties with retirement or recreational areas grew by nearly 4 percent, a rate well above the national average.

This surge is driven by the region’s appealing features: warm summers, mild winters, wide-open spaces, stunning scenery, and relatively affordable living costs. Towns like Abingdon, Virginia, have become particularly attractive, with Southern Living highlighting it as a prime retirement spot. As of March 2024, Zillow reported the average home value in Abingdon was around $263,000, a far cry from the $600,000 average in Naples, Florida. The absence of hurricanes, minimal threat from alligators, and moderate need for air conditioning further enhance the appeal.

Despite the upsides, the boom hasn’t been without challenges. Increased traffic clogs narrow, winding roads, and rising costs have strained some long-time residents. This tension has led some locals to wish the “half-backs” would head back north. However, with the U.S. population aged 65 or older projected to grow from just over 49 million in 2016 to over 85 million by 2050, the influx of retirees into Southern Appalachia is likely to continue.

The changing face of Southern Appalachia showcases the complexity of demographic shifts. While retirees bring economic growth and vibrancy, balancing this with the needs of long-standing residents presents a challenge that will shape the region for years to come.

Real Estate

The Real Cost of Homeownership: Beyond the Mortgage

Owning a home is a significant milestone that symbolizes stability and independence. However, the journey to homeownership involves more than just securing a mortgage and making monthly payments. Several other costs are integral to the ownership experience, often surprising new homeowners. Here are five essential costs associated with homeownership that deserve attention and planning:

1. Property Taxes: The Hidden Variable

Property taxes are a critical but often underestimated aspect of homeownership costs. These taxes are determined by your property’s assessed value and your local tax rate, which can vary significantly from one location to another. It’s important to research and factor in these costs, as they can substantially impact your overall budget.

2. HOA Fees: Community Living Comes at a Cost

Living in a community with a Homeowners Association (HOA) brings certain perks, such as access to amenities and communal area maintenance. However, these benefits come with a monthly or annual HOA fee price tag. Depending on the services provided, these fees can be hefty and should be considered in your budgeting process.

3. Maintenance and Repairs: The Ongoing Investment

The responsibility for maintenance and repairs falls squarely on homeowners, a shift from the renter’s experience where the landlord typically handles such concerns. Regular maintenance tasks like lawn care, HVAC system servicing, and exterior upkeep are not just time-consuming but can also be expensive. Additionally, unforeseen repairs can arise at any time, necessitating an emergency fund to avoid financial strain.

4. Insurance: Protecting Your Home

Homeowners insurance is non-negotiable for protecting your property against unforeseen events. The cost of insurance varies based on your home’s location, size, and chosen coverage level. Additional policies for flood or earthquake coverage might be necessary in areas prone to natural disasters, adding to the overall cost.

5. Utility Bills: The Cost of Comfort

Utility expenses often increase when moving from renting to owning, as homeowners typically occupy larger spaces than renters. Essential services such as electricity, gas, water, and sewage must be accounted for in the monthly budget. These costs can fluctuate based on usage, seasonal changes, and local rates.

Planning for the Future

Understanding these costs is crucial for prospective homeowners. Budgeting for these expenses ensures that you cannot only buy a home but also afford to live in it comfortably. Consulting with real estate professionals and insurance agents can provide a clearer picture of what to expect, helping you prepare for the full spectrum of homeownership costs.

Homeownership is a rewarding journey but requires thorough preparation and informed decision-making. Acknowledging and planning for these additional costs can ensure a smoother and more enjoyable homeownership experience.

Real Estate

Finding Your Perfect Neighborhood: A Comprehensive Guide

Deciding on the right neighborhood for your next home is as crucial as choosing the house. The community you move into impacts your daily life and your long-term satisfaction with your home. Here are key factors to guide you through decision-making, ensuring you find a neighborhood that fits your needs and lifestyle.

1. Budget Considerations

Start by defining your budget, which will narrow your search to neighborhoods that align with your financial capabilities. Remember, the cost of living varies widely between different areas, so consider both property values and the general living expenses of the neighborhood.

2. Commute and Accessibility

Your daily commute plays a significant role in your quality of life. Look for neighborhoods that offer ease of access to your workplace, schools, and other important destinations. A shorter, more convenient commute can save time and reduce stress.

3. Safety and Security

Safety is paramount. Investigate crime statistics and speak with local law enforcement or community members to get a sense of the neighborhood’s safety. A safe environment is essential for peace of mind and the well-being of your family.

4. Amenities and Lifestyle

Match the neighborhood amenities with your lifestyle needs. Whether it’s parks, restaurants, shopping centers, or cultural attractions, choosing an area that caters to your interests and hobbies can greatly enhance your living experience.

5. Educational Opportunities

For families with children or plans for them, the quality of local schools is a top priority. Research school districts and educational opportunities in the area, as access to quality education is a key factor in your decision.

6. Growth and Development

Investigating the neighborhood’s potential for growth and development can give insights into future property values and community improvements. An area with a positive outlook can be a good investment for your family’s future.

7. Community and Neighbors

A strong sense of community can make a big difference in your happiness. Try to gauge the neighborliness and social activities within the area. A welcoming and active community can greatly enhance your home life.

8. Matching Your Lifestyle

Consider whether the neighborhood reflects your desired lifestyle. From bustling city life to peaceful suburban or rural settings, choosing an environment that aligns with your preferences is key to feeling at home.

9. Trust Your Instincts

Finally, trust your instincts. Visit prospective neighborhoods, talk to locals, and try to envision your life there. Your personal comfort and feelings about the area should significantly influence your decision.

Seeking the advice of real estate professionals who understand local market trends can provide valuable insights into different neighborhoods. Taking the time to research and consider these factors will help you choose not just a house but a home where you and your family can thrive.

Real Estate

One-Year Credit Improvement Plan for Aspiring Homebuyers

Real Estate

Navigating Real Estate Appraisals: A Comprehensive Guide

In the intricate dance of buying or selling a home, real estate appraisals play a pivotal role in setting the stage for a fair transaction. Understanding the ins and outs of real estate appraisals can demystify the process and help you confidently navigate your home journey. Here’s the essential information you need to grasp the world of real estate appraisals.

The Purpose of an Appraisal

Real estate appraisals are conducted to pinpoint a property’s market value. This valuation is crucial for multiple reasons, serving as a cornerstone for mortgage lending decisions, property tax assessments, estate planning, and even savvy investment analyses. An appraisal gives all parties involved a clear picture of a property’s worth at a given time.

The Role of the Appraiser

Central to this process is the appraiser, a licensed and certified professional whose job is to offer an impartial and informed estimate of the property’s value. Appraisers are trained to remain unbiased, ensuring their valuation is based solely on data and observable conditions, not personal or external pressures.

Factors Influencing Appraisal

An appraisal isn’t just a number pulled out of thin air; it’s a meticulously calculated figure influenced by a myriad of factors. These include:

- Location: The adage “location, location, location” holds, as the property’s surroundings significantly affect its value.

- Size and Layout: Larger homes and those with more desirable layouts generally command higher prices.

- Condition and Age: Newer and well-maintained properties tend to be valued higher.

- Features and Improvements: Upgrades and unique features can boost a property’s worth.

- Comparable Sales: Recent sales of similar properties in the area provide a benchmark for valuation.

The Appraisal Process

The appraiser’s evaluation is thorough. It begins with an inspection of the property to assess its condition and note any unique features. This is followed by research into comparable recent sales in the vicinity and an analysis of the broader market trends. The culmination of this process is a detailed report that outlines the appraiser’s findings and the reasoning behind the determined value.

Lender Requirements and Appraisal Costs

For those obtaining a mortgage, be prepared for the lender to request an appraisal. This step is to ensure the loan amount doesn’t exceed the property’s value, protecting the lender’s investment. The cost of an appraisal can vary but is usually the responsibility of the buyer, seller, or lender, depending on the transaction’s specifics.

Keeping Current

Real estate values are always in flux, influenced by market conditions, making appraisals time-sensitive. For the most current and precise assessment, reaching out to a local appraiser is advised.

Understanding real estate appraisals is key to navigating the property market. Whether you’re buying, selling, or refinancing, knowing the value of your property and the factors that affect it puts you in a stronger position to make informed decisions.

Real Estate

Transforming Urban Living: The Rise of Co-living Spaces

In the heart of bustling cities, a new trend is reshaping how we think about housing and community. Co-living spaces, the latest urban living evolution, offer a fresh take on the traditional apartment model. These communal living arrangements are not just changing the real estate game; they’re addressing the needs of a new generation of city dwellers seeking affordability, convenience, and a sense of community.

What is Co-living?

Co-living is a modern concept where individuals share common spaces like kitchens, living rooms, and workspaces while having private bedrooms. The model emphasizes community and shared experiences among residents, aiming to create a more connected and fulfilling urban life. It’s especially appealing to millennials and young professionals who value social connections, networking opportunities, and a lifestyle that balances privacy with community engagement.

The Impact on Real Estate

The surge in co-living spaces is more than a passing trend—it’s a response to the challenges of urban living. High costs and limited space in city centers have made traditional housing options less accessible for many. Recognizing this, real estate developers and investors are now focusing on creating purpose-built co-living properties. These projects are not just innovative solutions to housing demands; they represent a lucrative new direction for the real estate market.

Addressing Urban Challenges

Co-living offers a promising solution to some of the most pressing urban issues, such as housing shortages and the rising cost of living. By maximizing space efficiency and promoting shared resources, co-living spaces can offer more affordable living options without sacrificing quality or location. Moreover, these arrangements encourage sustainable living practices, from reduced energy consumption to shared goods and services, contributing to a greener urban footprint.

The Future of Urban Living

As co-living spaces proliferate, their impact on the urban landscape is undeniable. They are not only altering how real estate is developed and consumed but are also setting new standards for what it means to live in a city. The community-focused, sustainable, and flexible nature of co-living reflects the changing priorities of urban residents, suggesting a lasting shift in the fabric of city living.

Whether you’re considering an investment in the co-living market or looking for a new place to call home, it’s clear that co-living spaces are at the forefront of redefining urban living. With their blend of affordability, community, and sustainability, these spaces are poised to play a central role in shaping the future of our cities.

For those interested in exploring co-living opportunities, whether as a resident or investor, consulting with a local real estate agent can provide valuable insights into the evolving landscape of urban housing.