Shortly before the unexpected announcement he won’t seek re-election two days after the Democrat’s sweeping electoral victories in Virginia, I read U.S. Sixth District Delegate Robert Goodlatte’s glowing appraisal of the Trump-House Republican tax plan. In his “Legislative Update” our delegate painted so rosy a picture of the plan I was prompted to explore exactly what has been laid on the national table as tax reform by the Trump Administration and House Republicans.

I will use our now lame-duck Sixth District delegate’s appraisal as a starting point for that tax bill exploration:

The Sixth’s Bob Goodlatte at work – Pubic Domain Photos/Graphics

“After many months of work and discussion, I am encouraged by the introduction of the Tax Cuts and Jobs Act. At its very core this bill is about tax relief for American families. It nearly doubles the standard deduction to protect more of your hard-earned money, and lowers individual tax rates for low and middle income Americans,” Goodlatte began rosily, adding, “The Tax Cuts and Jobs Act will also help to bolster the growth of businesses of all sizes in the United States, and keep jobs in our communities instead of being shipped overseas.”

Well that all sounds GREAT – unless on that latter point the reason jobs will be kept home is that American workers are in the process of being reduced to a Third World labor force as far as wages and benefits are concerned; and as far as the first point – well, what if at best it’s partisan hyperbole, and at worst just NOT TRUE?!!?

Multiple media outlets across the country had a far different assessment after a first look at the November 2 Trump-House Ways & Means Committee roll out of the long ballyhooed tax reform plan. One even called it the groundwork for a new “Gilded Age” for America’s super rich. Some of those national reports led me to the analysis of an independent, non-partisan, non-profit tax watchdog group founded in 1980.

Independent analysis

The Institute on Taxation and Economic Policy (ITEP) estimates more than two-thirds (66%) of the proposed tax cuts would go to the richest one-percent (1%) of Americans. In all, ITEP estimates the Trump tax plan would give more than $100 billion in tax cuts to the wealthiest one-percent of Americans. People who earn at least $615,800 a year would enjoy an average tax cut of $90,610.

“Meanwhile, those who earn between $41,000 and $66,000 a year would see an average tax cut ranging from about $400 according to ITEP estimates, to $1,100 according to the Trump/House plan’s own estimates,” Truthout’s Lindsay Koshgarian reported.

And despite that “average” middle income savings, ITEP and other sources report some taxpayers in the middle income bracket would actually end up owing more taxes under the plan. According to the Reuters news agency, those other sources include administration officials – “Trump economic adviser Gary Cohn and Treasury Secretary Steven Mnuchin have also acknowledged that some people could see a tax hike” from the “tax cut” plan.

But HEY, what does a 37-year-old non-partisan tax watchdog group, or administration officials for that matter, know anyway?

I decided to take a look at a fairly independent Republican, not part of development of the plan at the House level, for another perspective. Prior to being laid up after a neighborhood lawn mowing dispute, Kentucky Republican Senator Rand Paul asked if the plan “was really Republican?”

Senator Rand Paul may be preparing to catch whatever is flying out of the House Ways & Means Committee regarding tax ‘reform’.

“This is a GOP tax plan? Possibly 30 percent of middle class gets a tax hike? I hope the final details are better than this,” Rand tweeted in response to the unveiling of the plan in the House Ways & Means Committee.

So we must ask, tax reform for those who really need it the most – the middle and lower working classes – or an early Christmas present for those who need it least; but would have you believe (with some delegates’ assistance) that when they’re not taxed on their millions and billions, it’s really everyone else (trickle, trickle) who is benefiting?

‘See how easy it’s going to be to file taxes now’ the president enthused at tax plan’s unveiling. An amused House Speaker Paul Ryan and House Ways & Means Committee Chair Kevin Brady yuk it up at the president’s slight of hand.

On Wall Street

I decided to try Wall Street and the conservative Wall Street Journal for reactions sure to trumpet the Trump tax plan as a BIG boon to the U.S. economy. But it seems that almost immediately Trump was tweeting that the Wall Street Journal just “doesn’t get it” as far as the plan’s positive impact on the economy.

While lauding the plan’s reduction of business taxes, the WSJ wrote that pro-growth aspect of the plan was “marred by a mess on individual taxes that makes that part of the code even worse than it is now.”

CBS’s Moneywatch reported a Committee for a Responsible Federal Budget analysis that estimates the plan’s “cuts will be worth a total of $5.8 trillion through 2027 while the tax increases will be worth $3.6 trillion. That would result in a net increase to the national debt of $2.7 trillion including interest” – with no stated plan on how that revenue gap will be filled.

But perhaps there is a plan – just a currently unstated one first verbalized by Republican strategist Grover Norquist some time ago – “We don’t want to destroy the federal government, we just want to shrink it to the size where it can be drowned in a bathtub.”

Way off Wall Street

Okay, let’s get off Wall Street and away from Republican ghosts – Greg Gardner of the Detroit Free Press noted the Trump-Republican tax plan includes elimination of a $7,500 tax credit applied to the purchase of hybrid and electric cars. Gardner observed, “Wiping out the credit would create another obstacle for automakers who are trying to nurture a market for battery-powered transportation” for automobiles ranging around $37,000 to $40,000 or so.

Hey, gotta keep old Secretary of State and former Exxon-Mobile CEO Rex Tillerson happy – even if he has not denied calling you a “(some such) moron”.

But if the plan strips economic incentives to promote development of alternative, less polluting means of motor transportation, it also lowers the corporate tax rate from 35 percent to 20 percent and repeals the estate tax – not things of major concern to middle or lower income Americans.

Interviewed by the ABC affiliate TV-3 in Harrisburg, PA, CPA Robert Wilson concluded that the reduction of tax brackets (from 7 to 4) “just results in people in the lower brackets paying more tax.”

Oh well, so much for the “little people” Mr. Goodlatte and pals have promised will benefit from the plan.

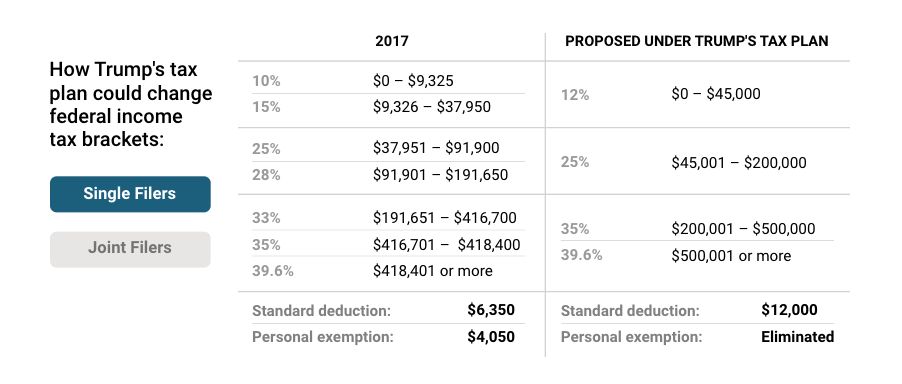

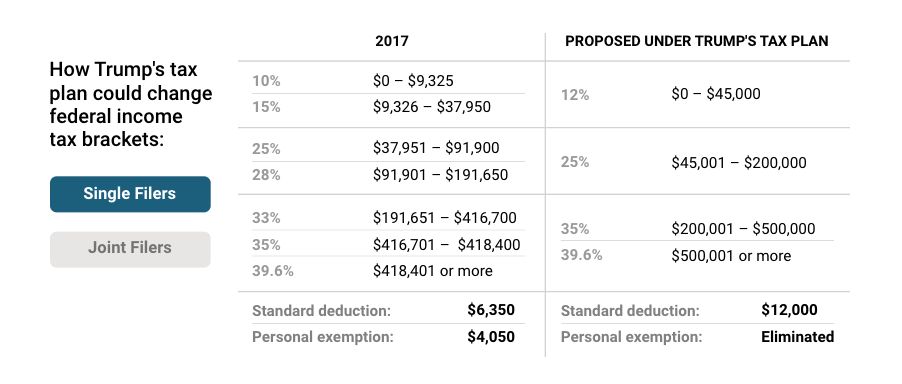

Above, proposed changes for single filers; below, for joint filing

Local government impacts

A story in the journal Governing: The States and Localities analyzed a potential impact on municipal governments nationwide:

“The bill would eliminate all private activity bonds, which allow tax-exempt municipal bonds to be issued on behalf of a government for a project built and paid for by a private developer … The proposal caught the infrastructure finance community completely off-guard … ‘For months, we’ve been hearing that munis were safe,’ said tax attorney Will Milford, of the firm Bryant, Miller, Olive.”

Why the alarm?

“Tax-exempt bonds fetch lower interest rates in the municipal market and therefore lower the overall cost of financing,” Governing explains, “The projects financed with this type of debt are typically things in the public interest, such as low-income housing, hospitals, airports” – and schools they might have added.

Governing called elimination of the low-interest bonds “devastating for governments trying to find money for economic development projects.”

Local government reactions

Such low interest bonds have been an important tool of local municipal capital improvement projects in Warren County for some years.

“The issue here is really about the ability to refinance bonds when the interest rates come down,” County Administrator Doug Stanley told us, observing, “The Board of Supervisors has been able to save a significant amount of money in past few years when we were able to refinance bonds associated with school construction.”

Long-time Warren County project consultant Springsted circulated a call to action in opposition to the plan forwarded to us by Stanley, “In addition to a dramatic cut in the corporate tax rate, the recently announced House tax bill takes serious, direct aim at the municipal bond market. Both measures are sure to interfere with state and local governments’ ability to cost-effectively provide financing for projects,” Springsted wrote.

EDA Executive Director Jennifer McDonald also alerted us to the fact that one national organization, The Council of Development Finance Agencies (CDFA) will discuss strategies to fight this provision of the tax plan at its upcoming National Summit in Atlanta. The CDFA called this aspect of the Trump-Republican tax bill “a move that would prove devastating to development finance efforts nationally.”

McDonald agreed, telling us, “Some of the proposed tax cuts and job acts could be detrimental to the economic development of not just this community, but the nation as a whole. Economic development relies on some of these very successful programs to create jobs and tax revenue for the community.”

Noting the tax bill “is the product of months of collaboration between senior members of the House, Senate, and White House” the CDFA said that “without major pushback and input there is a good chance the bill may become law.”

So it seems that like some middle-income Americans, the communities they live in may also be negatively impacted by the Trump-House Republican tax plan as presented after months of partisan development behind closed doors.

Back to Bob

But maybe there’s hope! After all, the ever-elusive Mr. Goodlatte concluded his “Legislative Update” initial praising of the tax plan rolled out under his nose by stating, “As the Ways and Means Committee prepares to consider this bill next week, I will carefully examine the details of the plan and how they will impact the Sixth District. I’ve advocated for common sense tax reform throughout my time in Congress, and I am pleased to see this effort move forward to deliver the tax relief folks in Virginia and across the country need. Let’s get down to business.”

I know I, for one, believe our Sixth District delegate when he says he’s getting ready to roll up those legislative sleeves and do some in-depth, non-partisan analysis of a Trump-Republican initiative that has been talked up for months as economic Nirvana for all.

NO I don’t. – But you knew that, didn’t you?

D-I-V-O-R-C-E

Okay, maybe I need a divorce from my Sixth District delegate – let’s just call it quits, Bob. After all, political representation is a lot like a marriage in its give and take and mutual responsibility, right? And I never see you anymore, Bob – at least not out here in the northwestern reaches of your district (or other districts too I hear from the “kids”).

Uh oh, not so fast.

‘Train in Vain’ – two days after Democrats stunning electoral gains in Virginia, Bob Goodlatte announced he is headed on down the tracks – but will he maintain support for the Trump-Republican House tax plan prior to his departure after the 2018 mid-term election?

Other than the fact I woke up today to find an “I’m leaving – soon” note from my delegate, Market Watch’s Quentin Fottrell writes, “There’s no longer a silver lining to paying spousal support. President Trump’s tax plan unveiled this week will abolish tax deductions on alimony. This won’t impact people who have already agreed on their payment amounts but – assuming the GOP tax bill is passed by Congress – this new arrangement will be in effect for divorce decrees on Jan. 1, 2018 and thereafter.

“This will create a total re-evaluation of divorce cases,” said Malcolm Taub, partner and co-chair of the divorce and family law practice group at Davidoff Hutcher & Citron LLP. “It’s major.”

“We settled a case this week in court where my wealthy client agreed to pay his dependent wife significant alimony because he could deduct it,” added Randy Kessler, an Atlanta-based lawyer who wrote the book, Divorce: Protect Yourself, Your Kids, and Your Future. “The deduction, as it stands, is a great motivator to encourage the higher wage earner to agree to help support the spouse with less income.”

Uh oh, you don’t think THAT’S what this whole tax “reform” charade is about, do you? – Melania, Melania, has anyone seen Melania since China?!!?

Public Domain Photo/theeconomiccollapse-blog.com